TRANSFORM your FINANCIAL FUTURE

and Unlock Life-Changing Opportunities with us!

LIMITED TIME: Get your FREE Credit Assessment + 1st Month FREE

Just 50 Openings

Your financial goals are within reach, and it all starts with achieving a high credit score. Imagine the possibilities. A strong credit profile doesn’t just lower your costs, it opens doors to the life you deserve.

Still struggling to make ends meet?

What if you could reduce your monthly expenses with better financial tools?

Picture this:

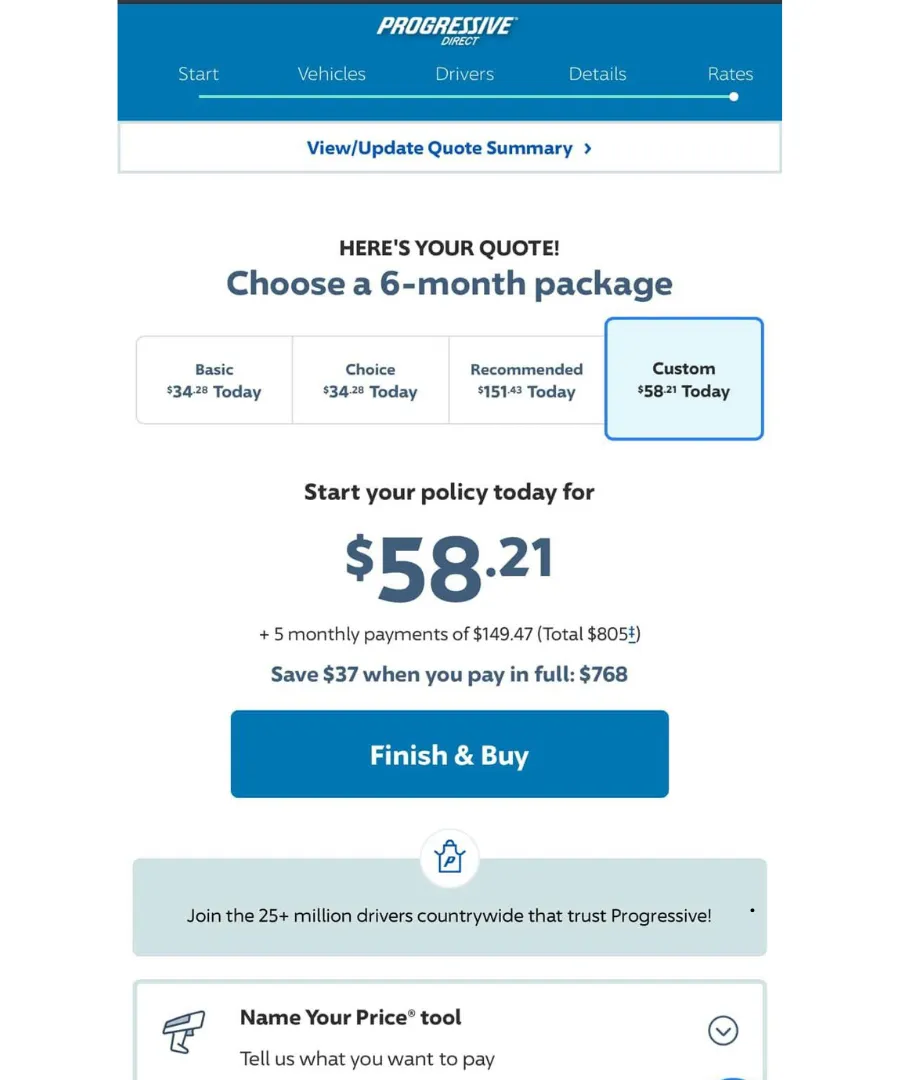

Drive the car you truly want with lower monthly auto payments and better loan terms.

Cut your insurance costs and maximize your savings.

Own your dream home , or renovate your existing one, with lower interest rates and higher approval chances.

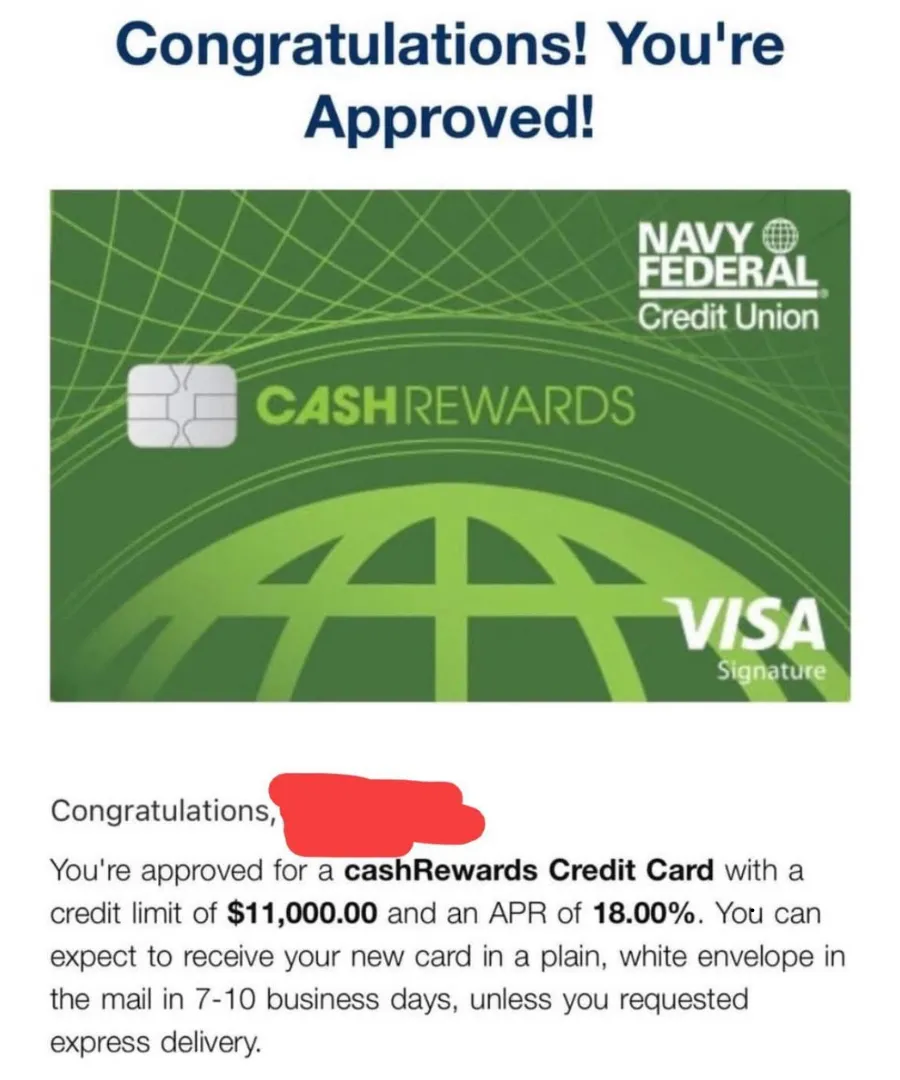

Access high-limit credit cards and take advantage of exclusive rewards like free vacations with earned points.

A high credit score means paying less for what you buy and getting more out of your money. It’s time to stop settling and start building a future full of freedom and opportunity.

More Than Credit Repair

It's a Complete Financial Empowerment Program

This isn’t your typical credit repair service. We’re offering a done-for-you mentorship experience designed to not only fix and strengthen your credit but to completely transform how you understand and manage your finances.

Here's some stuff:

We build your credit while teaching you the strategies to keep it strong for years to come.

Learn proven, legal financial tactics that can elevate your status into a higher class.

Benefit from weekly educational tips and strategies designed to empower you with the tools to succeed.

Whether it’s for your personal finances, your family, or even starting a business, we’ve got you covered.

Our mission is simple – to give you the knowledge, tools, and confidence to create the financial future you’ve always wanted.

You owe it to yourself to stop surviving and start thriving. Take the first step today and unlock a world of opportunities that a high credit score can provide.

Your brighter financial future starts NOW.

HOW IT WORKS

3 Simple Steps to Transform Your Credit

Achieving a strong credit profile has never been easier.

We’ve designed a straightforward, results-driven process to guide you every step of the way.

All done for you! Here's how it works:

Analyze & Strategize

We start by thoroughly analyzing your current credit situation and creating a personalized strategy tailored to your goals. Every plan is designed to maximize your success and set you on the path to financial freedom.

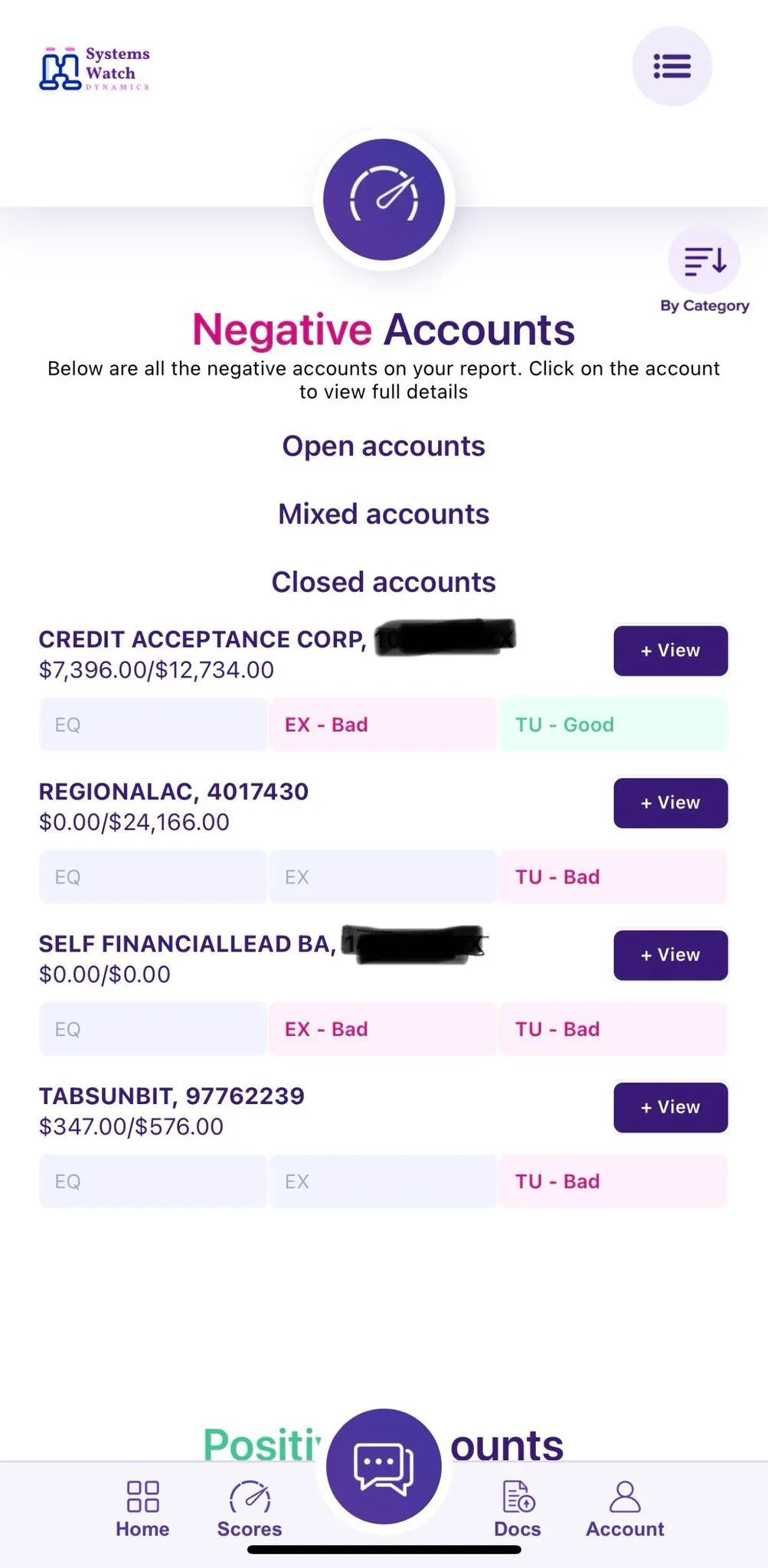

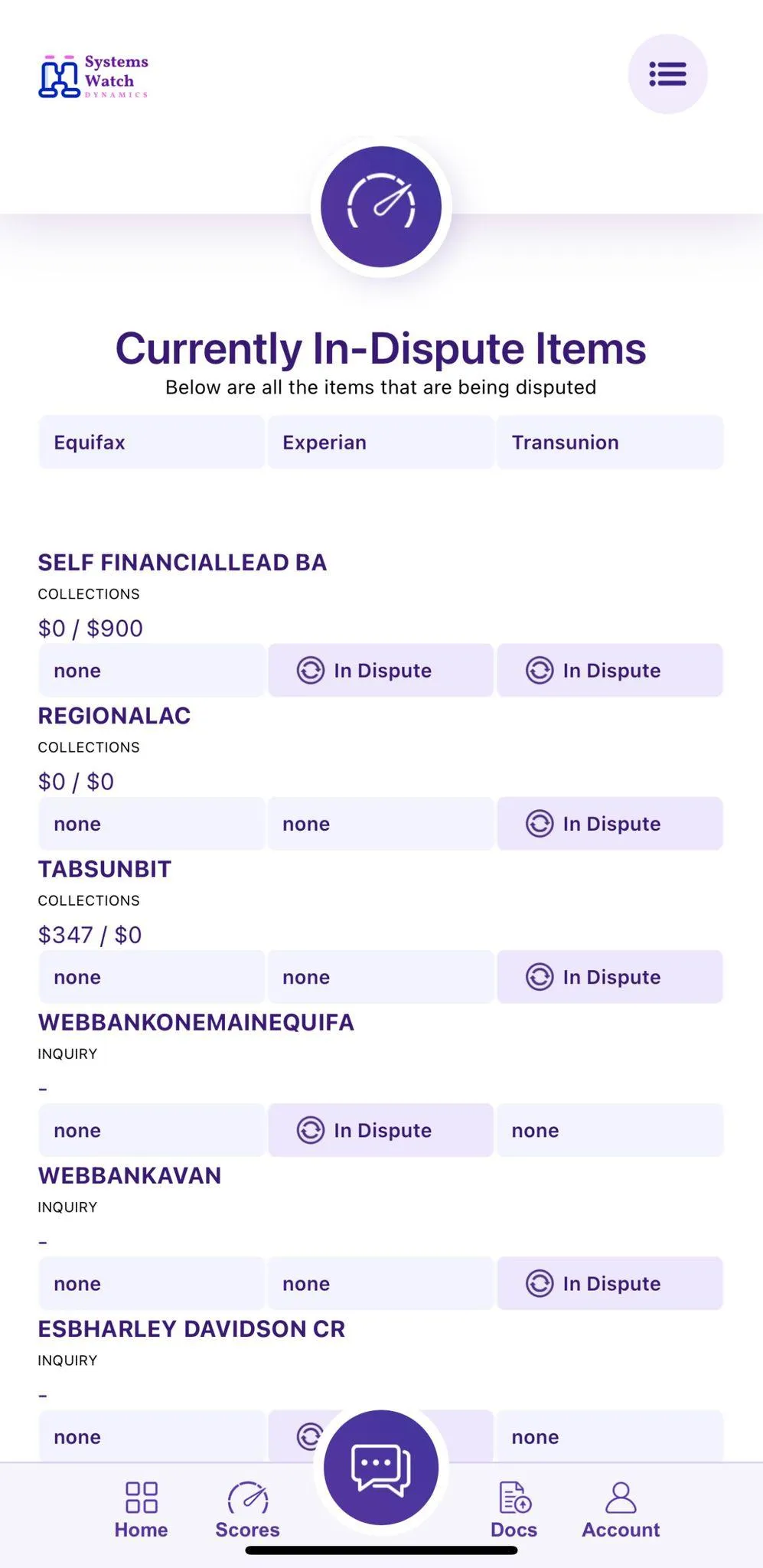

Dispute & Attack

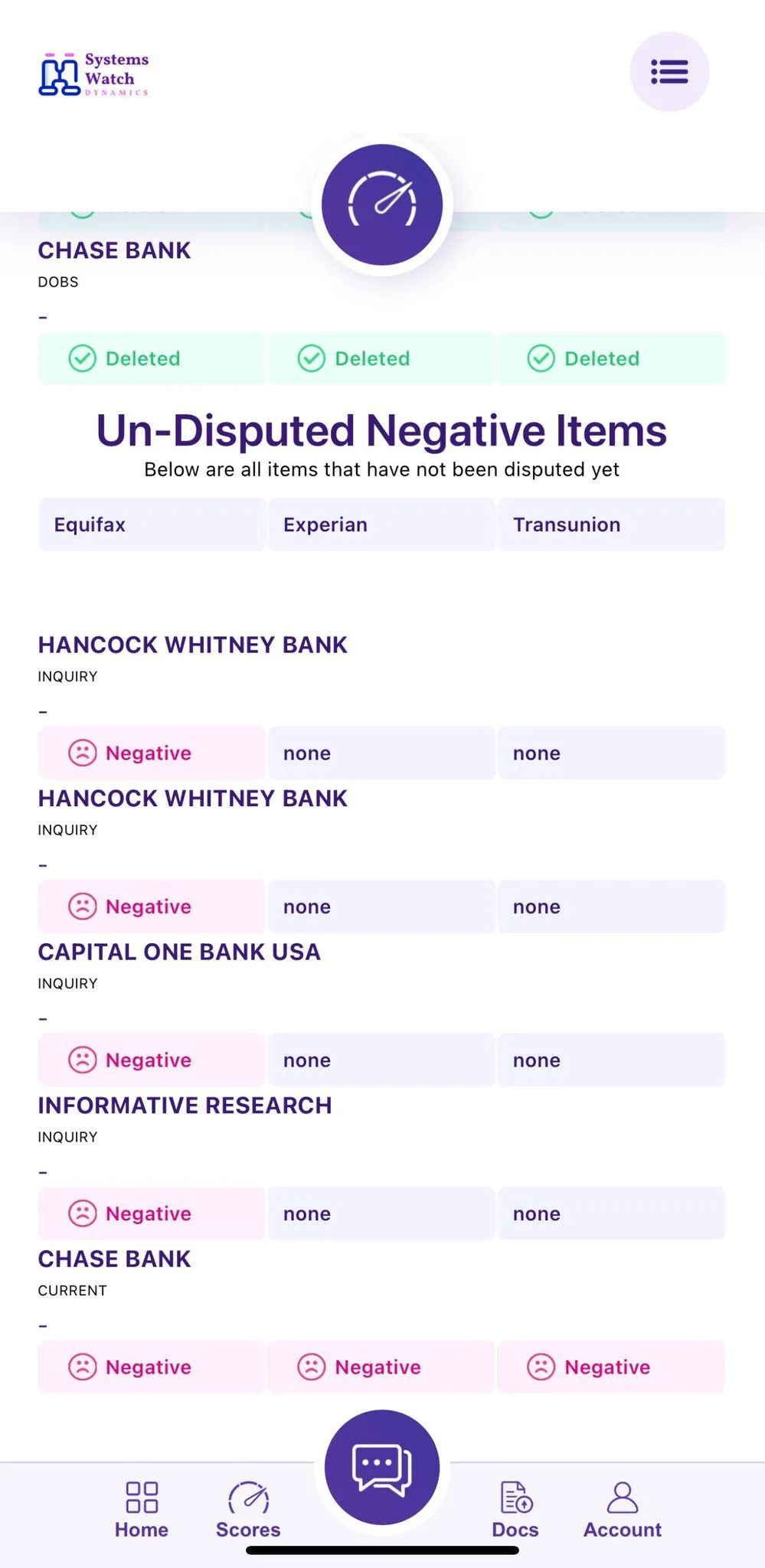

Next, we take action. Our team disputes inaccuracies, addresses negative items, and works tirelessly to clean up your credit report while boosting your profile. We’re relentless in ensuring your credit reflects your financial potential.

Track & Build

We don’t stop at fixing your credit. We continuously track your progress and provide guidance to help you build and maintain a strong, healthy credit profile. Our goal is long-term success, not just a quick fix.

Throughout your credit transformation, you’ll have all-access to our exclusive educational materials and private Credit Education Group. There, you can connect with experts, ask personalized questions, and gain insights to stay in control of your financial journey.

Your credit repair experience should be empowering and stress-free.

Take the first step today, we’re here to make it happen!

How We Stand Out from Other Credit Repairs

When it comes to improving your credit, we go above & beyond to deliver results and provide lifelong value.

Here’s what makes us different from the rest:

Unlimited Disputes Across All Three Credit Bureaus

We don’t limit the number of disputes we file. If there’s an issue on your credit report, we’ll relentlessly work to resolve it, giving you the best possible outcome.

90-Day Money-Back Guarantee

Results matter, and we stand by our commitment to you. If you don’t see real progress within 90 days, we’ll refund your money. Your trust is our priority.

Exclusive Client Private Group

Gain access to our private community where you can ask personalized questions about your credit, set goals, and connect with experts who are invested in your success. You’ll never feel alone in your credit repair journey.

Educational Materials, Blogs, and Tips

Knowledge is power, and we’re here to empower you. From practical tips to in-depth resources, we provide the tools you need to not only fix your credit but to maintain a strong profile for years to come.

We Tackle Secondary Data Furnishers

Did you know hidden data furnishers can secretly impact your credit? These entities sell false or outdated information about you, which could lead to denied apartment leases, rejected loan applications, high credit card interest rates, or even inflated car insurance premiums. We uncover and address these inaccuracies that might be silently holding you back from financial freedom.

No other credit repair company combines aggressive action, thorough strategies, and personal empowerment like we do. We don’t just fix your credit, we help rebuild your financial confidence and unlock a brighter future. Together, we’ll transform your credit and give you the tools to thrive!

Customized Strategies to Build a Strong, Seasoned Credit Profile

If credit repair isn't what you need, check out our collection of Financial Literacy eBooks! These resources are designed to guide you on budgeting, saving, and building financial dependence.

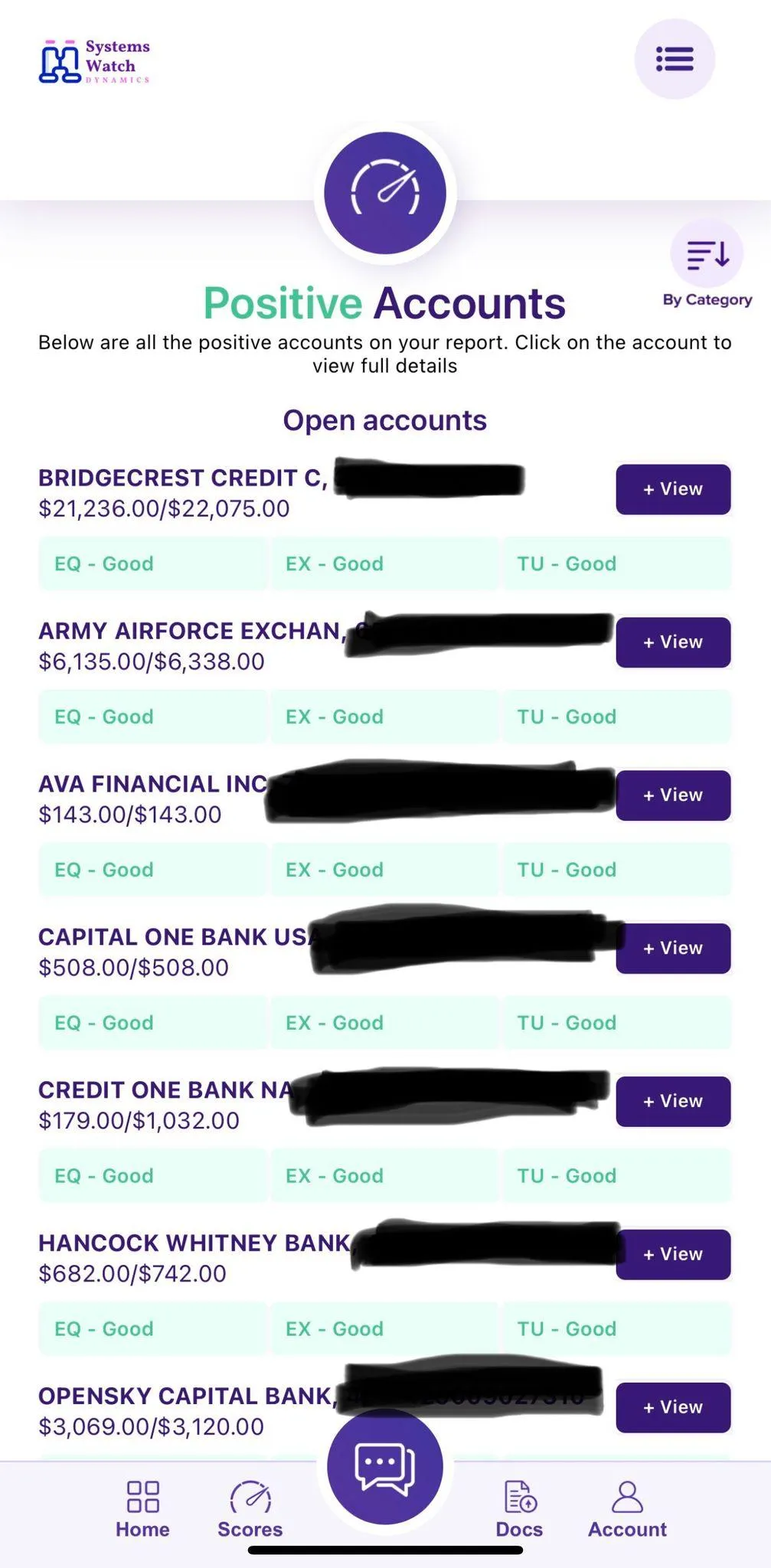

Banks look deeper than the score itself, and we ensure your credit profile has the key components they want to see, including:

Major Bank Credit Cards

A Strong Credit Mix

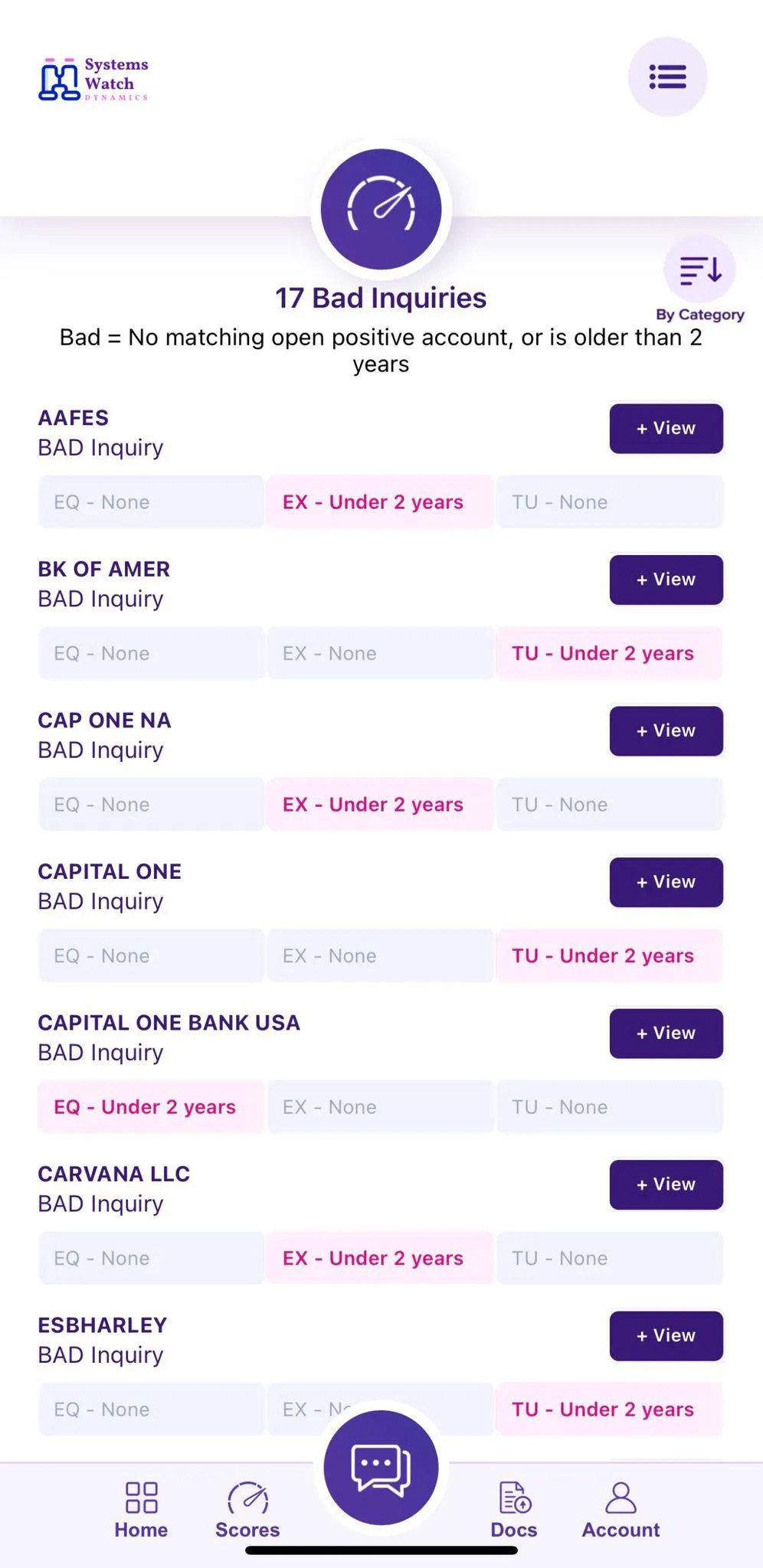

Minimal Credit Inquiries

At least two major bank credit cards with credit limits of $2,600 or more. These accounts showcase your ability to manage significant credit responsibly.

A diverse credit portfolio that may include an auto loan, personal loan, revolving credit, mortgage, or strong rental history. Plus, banks prefer to see these accounts actively managed and aged at least 2 years.

To maximize approval chances, your profile should reflect fewer than two recent credit inquiries. This reassures lenders that you’re selective and responsible with credit applications.

We also recommend credit products specifically suited to your unique financial situation, helping you establish and build the foundation for a resilient and trusted credit history. With our tailored approach, we aim to do more than just help you reach an 800+ credit score, we’ll guide you to creating a credit profile that opens the doors to real financial opportunities.

Active Duty &

Veteran Credit

As retired Navy veterans, we understand the sacrifices you’ve made and the unique financial challenges that come with serving our nation. That’s why we’ve built a credit repair service specifically designed for our heroes, active duty service members and veterans like you.

We know how deployments, frequent relocations, and unexpected expenses can impact your credit. With our firsthand knowledge and expertise, we use proven strategies tailored to your needs to help you clean up your credit, rebuild your score, and create a strong financial foundation.

You’ve served our country with honor, now it’s time for us to serve you. We’re here to help you achieve financial stability and unlock the opportunities you deserve. Take the first step today, your financial mission starts here!

NEW TO THE USA AND NEED TO BUILD CREDIT

..Build Your Financial Future here..

Starting a new life in a new country is exciting but can come with its challenges, especially when it comes to credit. For immigrants in the United States, building a strong credit profile is essential for achieving your dreams, whether it’s buying a car, owning a home, or growing a business. However, without a U.S. credit history, navigating the financial system can feel overwhelming. That’s where we come in. Our credit repair and building service is designed specifically to help immigrants take control of their financial future.

Here's how we support you step by step:

Overcoming Credit Challenges Immigrants Face

We understand that as a newcomer, you often start with no established credit or may face errors caused by incomplete or misunderstood information in your credit profile. On top of that, figuring out how to build credit can be confusing without proper guidance. These obstacles can make it harder to access affordable interest rates, qualify for loans, or even rent a home.

Our team has the experience and expertise to resolve these issues. We specialize in cleaning up your credit profile and helping you establish or repair credit quickly, so you can stop feeling stuck and start building the life you want.

Actionable Credit Repair & Tailored Solutions

Here’s how we help you build a strong, reliable credit profile in the United States:

Credit Report Clean-up:

We audit your credit report for inaccuracies, outdated items, or unverifiable information. From incorrect personal details to negative items, we dispute them all to give you a clean slate.

Education and Guidance:

We don’t just fix your credit, we empower you with the knowledge and tools to maintain it. You'll gain access to educational resources designed to help you understand the U.S. credit system, build a solid credit history, and make informed financial decisions.

Establishing Positive Tradelines:

Once we address the negative items, we help you establish new lines of credit, like secured credit cards, credit-builder loans, and more, tailored to your financial situation. This ensures you lay the foundation for a positive and growing credit score.

Personal Profile Optimization:

From reducing credit inquiries to resolving issues with public records or outdated addresses, we optimize your credit profile for success.

Credit Report Clean-up:

We audit your credit report for inaccuracies, outdated items, or unverifiable information. From incorrect personal details to negative items, we dispute them all to give you a clean slate.

Education and Guidance:

We don’t just fix your credit, we empower you with the knowledge and tools to maintain it. You'll gain access to educational resources designed to help you understand the U.S. credit system, build a solid credit history, and make informed financial decisions.

Establishing Positive Tradelines:

Once we address the negative items, we help you establish new lines of credit, like secured credit cards, credit-builder loans, and more, tailored to your financial situation. This ensures you lay the foundation for a positive and growing credit score.

Personal Profile Optimization:

From reducing credit inquiries to resolving issues with public records or outdated addresses, we optimize your credit profile for success.

Why Your Credit Matters

A strong credit score isn’t just a number, it’s a key to unlocking opportunities in the U.S. A good score can help you qualify for better interest rates, rent an apartment, secure a job, or even start your own business. It's about creating stability, independence, and success for you and your family.

Why choose us?

Culturally Sensitive Support: We understand the unique challenges immigrants face and are here to offer personalized, judgment-free support.

Proven Strategies for Success: Our team uses proven methods based on consumer protection laws to address even the most complicated credit issues.

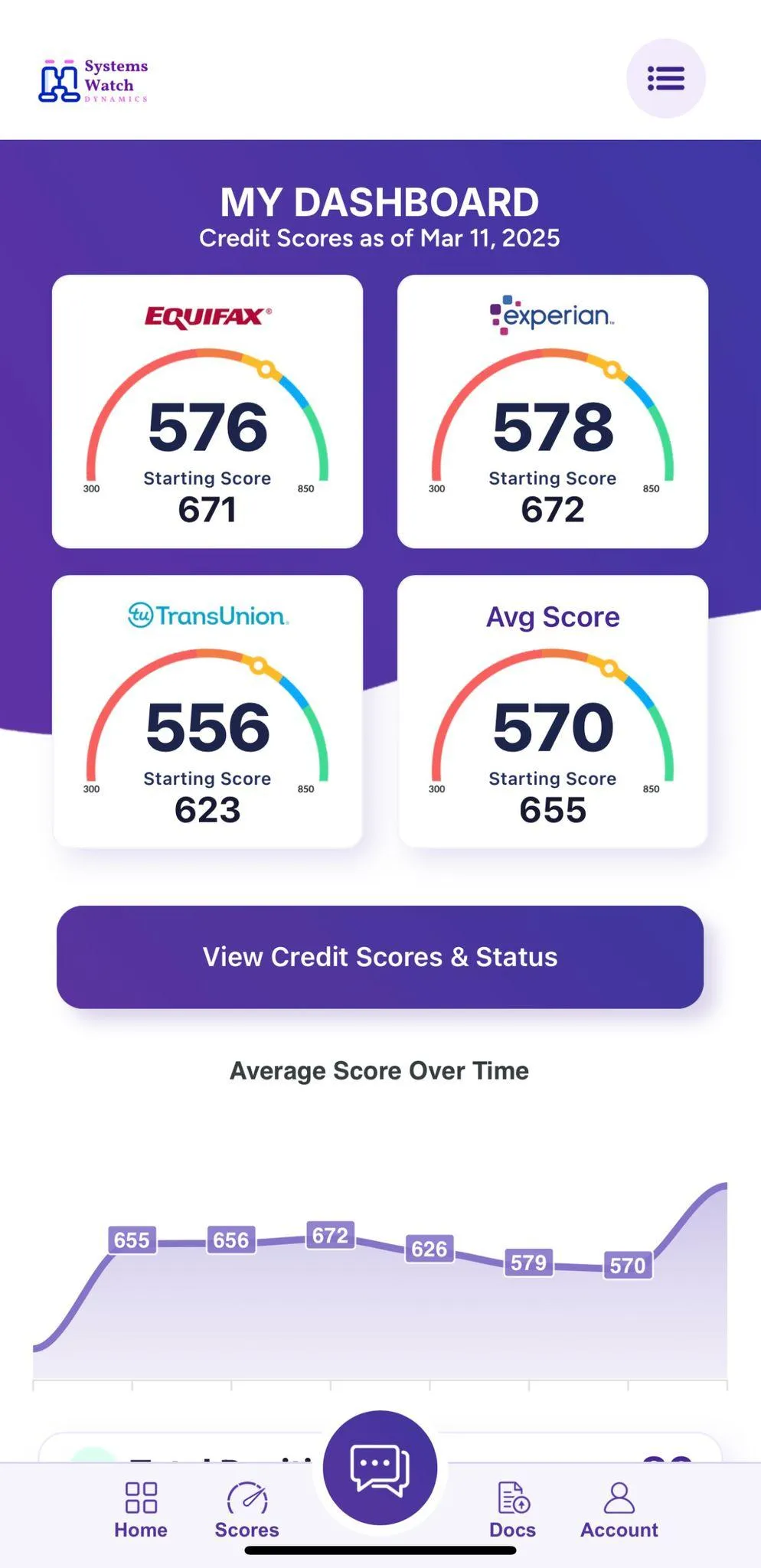

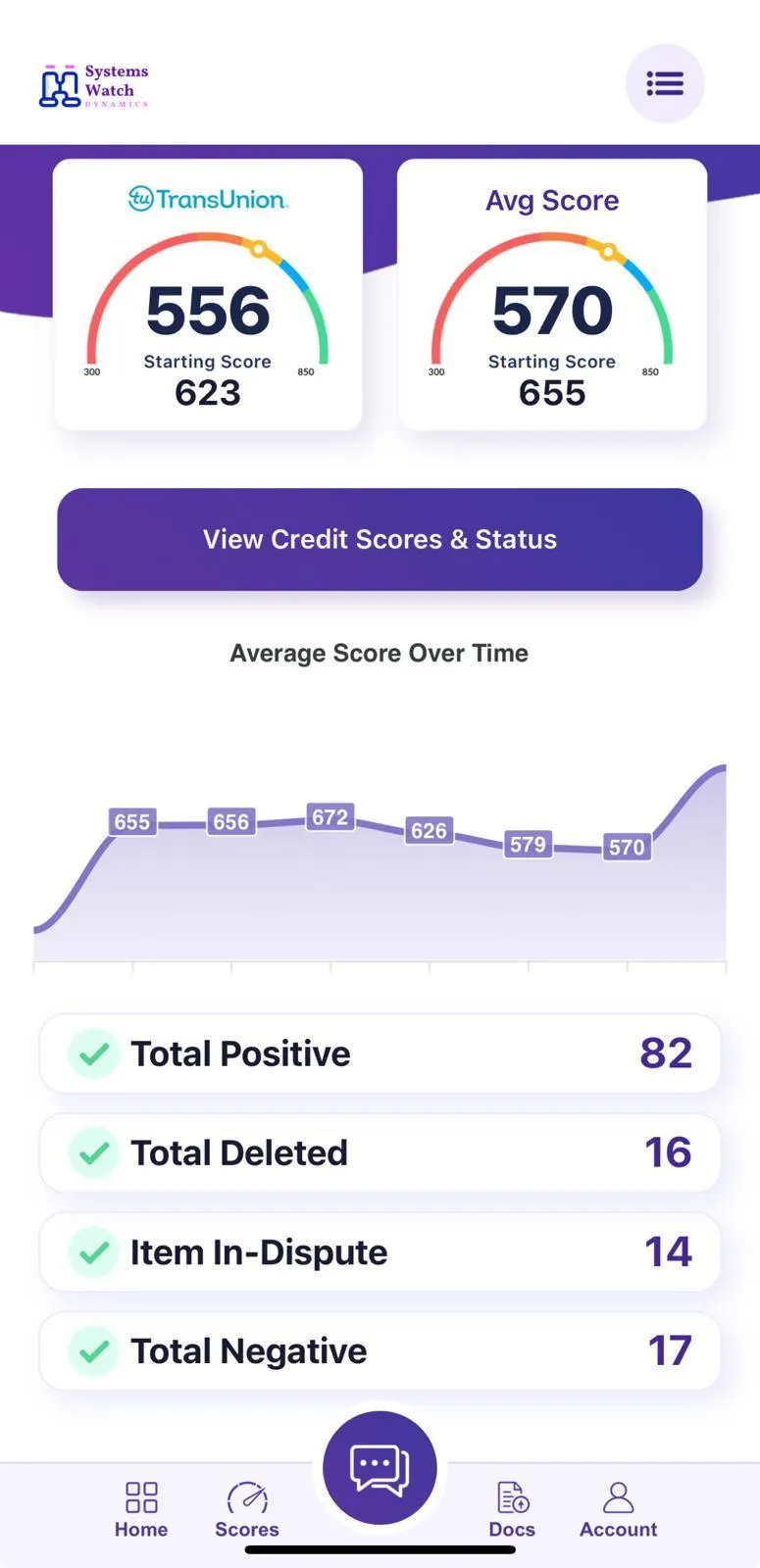

Comprehensive Tools: From a client portal to track your progress to a credit score tracker app, we make the process transparent and accessible.

Take the First Step Toward Financial Freedom

You came to the U.S. to build a better future, don’t let credit concerns hold you back. With our credit repair and building services, you’ll gain the support, resources, and tools needed to thrive financially.

We’re here to help you every step of the way!

Start your credit repair journey today and turn your American dream into reality.

Reach out now for a free consultation, we can’t wait to be part of your success story.

What's Holding You Back?

Credit Inquiries

Too many recent applications can signal financial instability to lenders.

Collections

Unpaid debts sent to collections can severely impact your score

Bankruptcies

Filing for bankruptcy stays on your credit report for years, affecting your creditworthiness.

Repossessions

Losing a financed asset, like a car, can hurt your credit profile.

Public Records

Negative public filings can make obtaining credit challenging.

Tax Liens

Some tax debts show up on credit reports and harm your score.

Charge-offs

Accounts written off by creditors indicate unpaid debts.

Child Support

Missed payments may be reported and lower your score.

Late Payments

Even one late payment can damage your credit history.

Judgements

Legal judgments against you can appear on your credit report.

Medical Bills

Unpaid medical debt can end up in collections.

Foreclosures

Losing your home affects both your credit and future borrowing ability.

Evictions

Rental issues can harm your report and rental history.

Student Loans

Defaulted loans impact your score significantly.

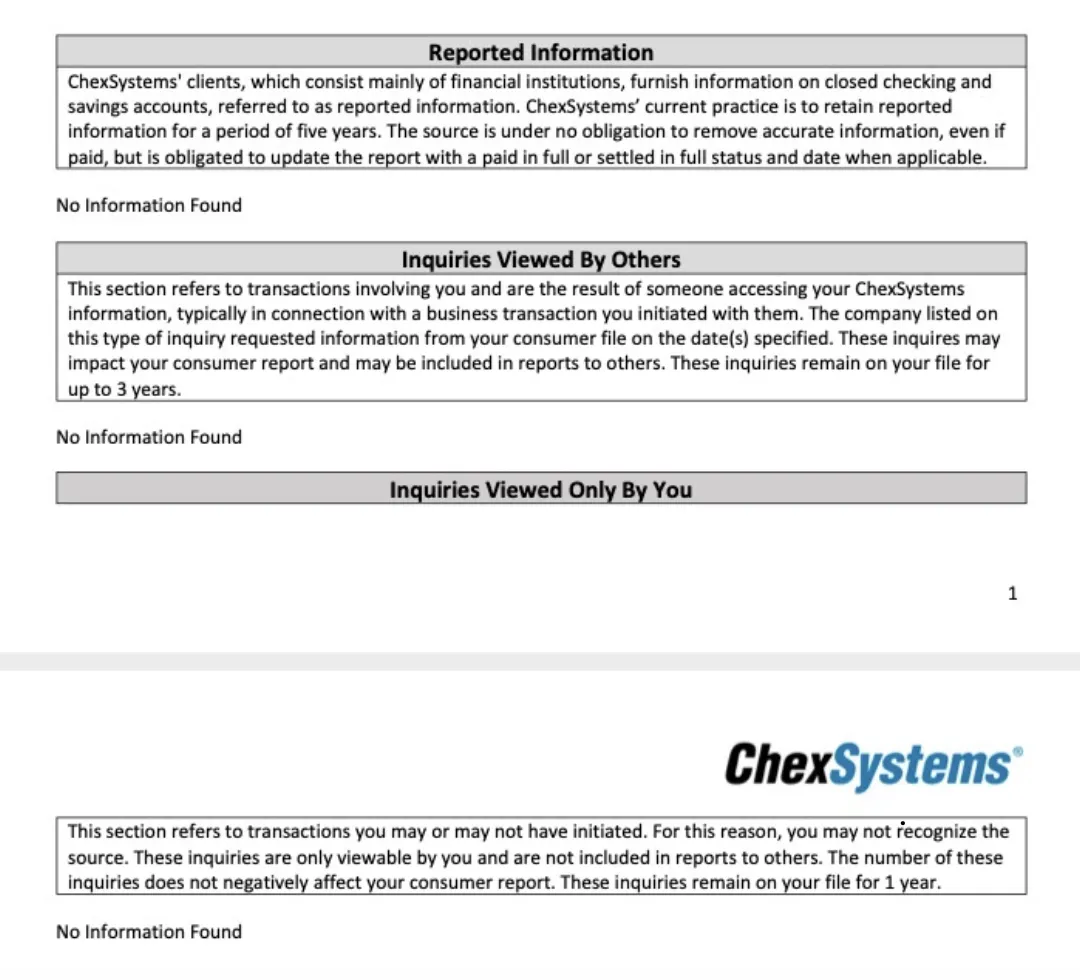

CheckSystems

Closed bank accounts with outstanding balances signal financial trouble.

Personal Information Errors

Incorrect or multiple versions of your name, wrong addresses, or outdated info can lead to credit denials.

These obstacles not only lower your score but also limit your financial opportunities. Identifying and addressing them is a vital step toward improving your credit!

TRANSFORM YOUR FINANCIAL FUTURE

OVERCOME CREDIT CHALLENGES WITH SYSTEMS WATCH DYNAMICS

Is Your Credit Holding You Back?

Struggling with high-interest rates because of a low credit score?

Frustrated that your credit is keeping you from securing a car loan?

Dreaming of launching your business but your credit is standing in the way?

Feeling powerless as your credit score blocks the path to your dream home?

Living with constant stress, knowing a financial emergency could spiral out of control due to poor credit?

If any of these challenges sound familiar, SYSTEMS WATCH DYNAMICS is here to change your story. Our proven strategies are designed to tackle your credit issues head-on, resolve roadblocks, and empower you with the financial freedom you deserve. Stop letting credit struggles define your future, take control today!

CREDIT TRANSFORMATION WITH SIMPLE PRICING

An affordable Credit repair plan designed to help you rebuild your credit and unlock new financial opportunities, without the hassle. Plus as a bonus we provide real credit strategies and education to empower you and your family financial freedom

Rebuild your credit and unlock a world of financial opportunities with our hassle-free, comprehensive credit repair program. Designed with affordability and results in mind, this plan offers everything you need to take control of your financial future.

Key Features and Benefits:

90-Day Money-Back Guarantee:

No results? No problem. We promise a full refund within 90 days if we haven’t delivered improvements.

Cancel Anytime:

Enjoy the flexibility to cancel without fees or penalties.

Low Enrollment/Audit Fee:

Begin your credit repair journey without breaking the bank.

Comprehensive Credit Analysis:

Receive an in-depth review of your credit history to identify areas for improvement.

Unlimited Disputes:

We handle disputes across all three major credit bureaus, leaving no stone unturned.

Client Portal:

Stay updated on your progress with 24/7 online access to your account.

Credit Score Tracker App:

Monitor changes and track your credit score conveniently in real-time.

Aggressive Monthly Disputes:

Consistent disputes ensure we target evictions, inquiries, and other negative items.

Added Bonuses to Empower You:

Personal Profile Cleanup: Resolve errors like incorrect names, addresses, and more for a polished credit report.

Private Member Group: Gain direct access to credit experts, ask questions, and share success stories.

Proven Credit Strategies: Learn the techniques to build a strong, seasoned credit profile banks love.

Educational Resources: Access blogs, materials, and tools designed to enhance your financial knowledge and help you sustain long-term success.

Take control of your credit today with our straightforward plan and experienced team by your side. It’s more than just credit repair, it’s your pathway to financial freedom!

READY TO GET YOUR FREE CREDIT ANALYSIS REPORT TODAY?

Get a detailed, free credit report and uncover ways to boost your score in just a few clicks!

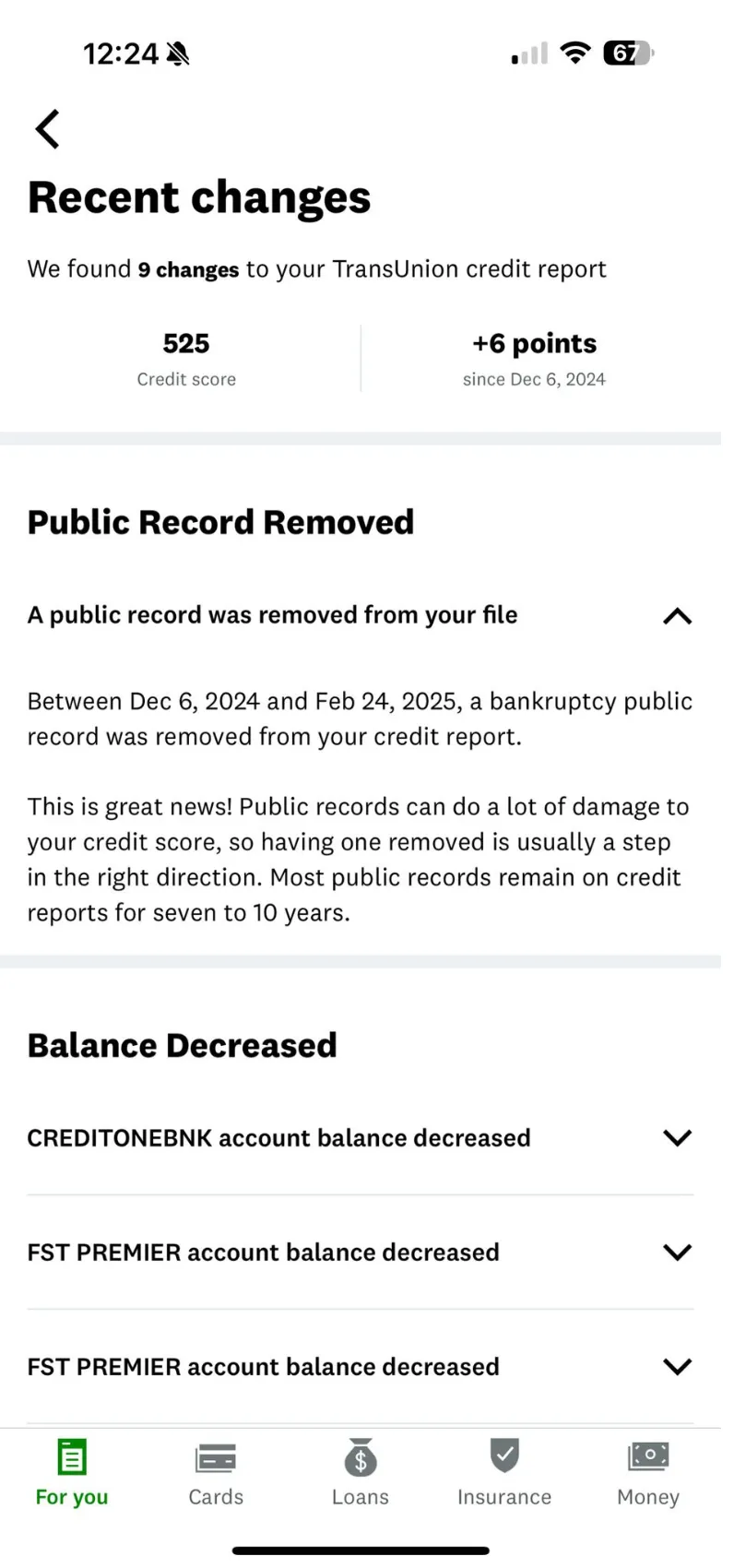

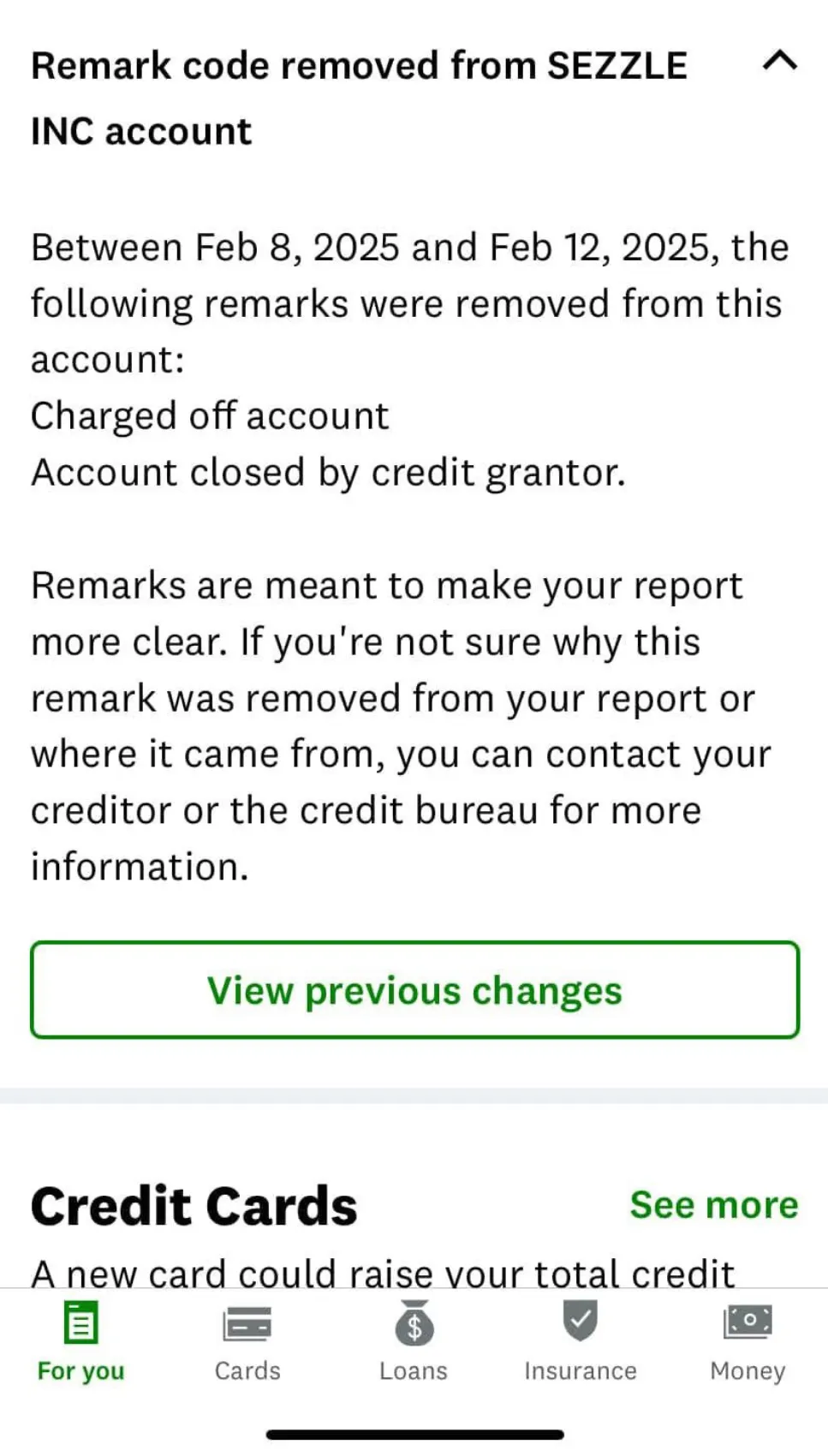

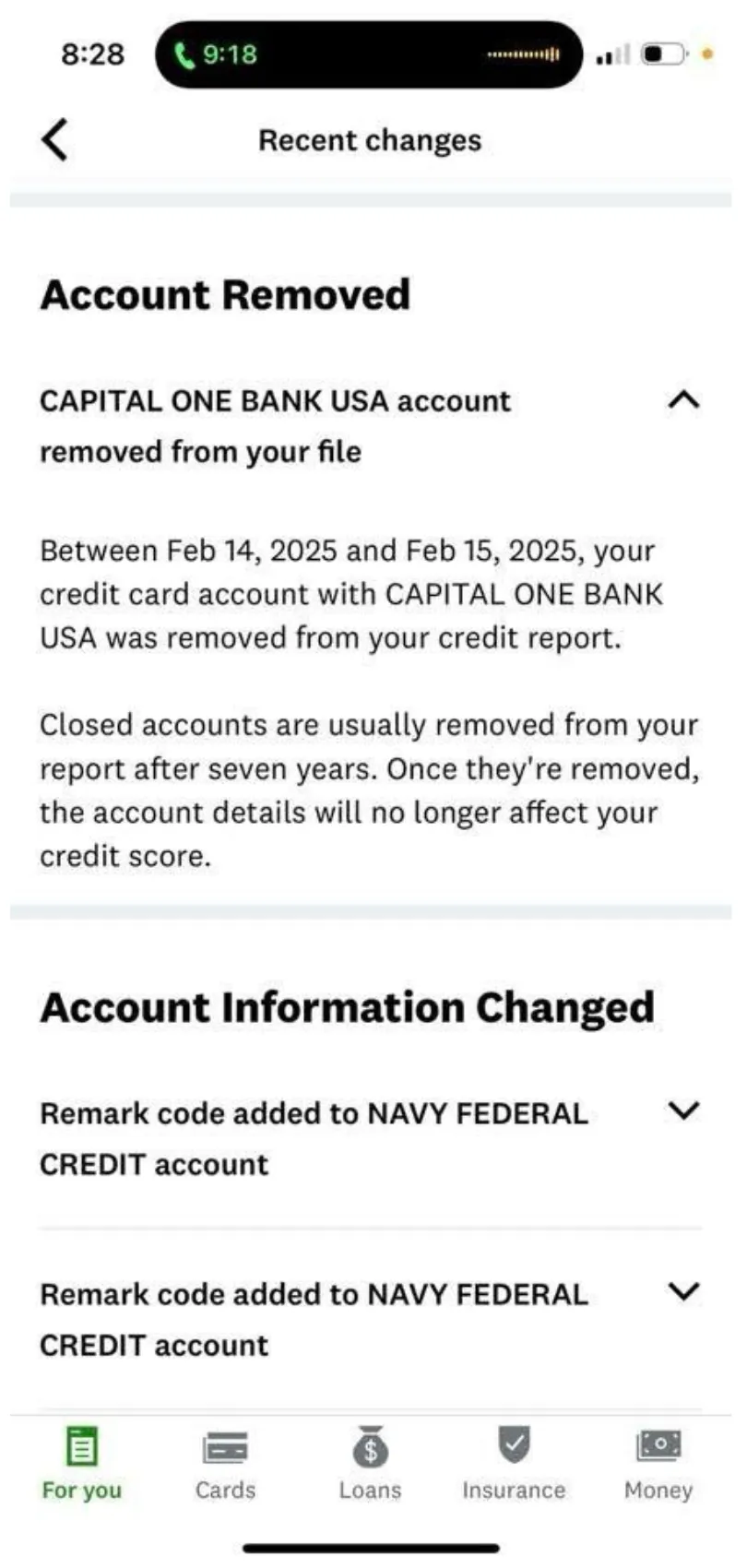

REAL RESULTS in just under 90 days!

Bankruptcy Removal

Charge-off Account Removed

Collections Account Removed

WHAT OUR CLIENTS ARE SAYING!

ALL-IN-ONE CREDIT SOLUTIONS

Repair, Monitor, Consult

ONE PRICE . ZERO HASSLE

Are you tired of juggling multiple subscriptions just to stay on top of your credit health?

Other companies like Lexington Law, Credit Saint, and The Credit Pros might help repair your credit, but you’re left paying up to $35 more a month separately for credit monitoring services with platforms like IdentityIQ, MyScoreIQ, or SmartCredit. That’s an extra hassle you don’t need when working toward financial freedom.

Welcome to Systems Watch Dynamics, where we believe improving your credit shouldn’t come with extra headaches!

Here’s why we stand apart from the rest:

One Solution. One Price.

At Systems Watch Dynamics, we simplify credit management by bundling credit monitoring, credit repair, personalized credit consulting, and credit education into one easy monthly subscription.

No hidden fees.

No separate accounts.

Everything you need, all in one place.

The Full Package You Deserve

When you join us, you get access to a complete suite of services designed to meet your unique financial needs:

Credit Monitoring: Stay in the know with real-time updates on your credit activity.

Credit Repair: Work with our experts to challenge errors and optimize your credit score.

Personalized Consulting: Get tailored advice and strategies to suit your financial goals.

Comprehensive Credit Education: Understand your credit better with resources aimed at empowering you for the future.

Convenience Meets Expertise

With Systems Watch Dynamics, you’re not just improving your credit. You gain a trusted partner that simplifies the process and helps you stay on track. Unlike other services, we offer all-in-one support so you can focus on what matters most; building the future you deserve.

Why Settle for Less?

Say goodbye to separate subscriptions and fragmented credit management. With Systems Watch Dynamics, you’ll receive a comprehensive solution for an affordable monthly price. Other companies might focus on one piece of the puzzle, but we deliver the full picture so you can move forward with confidence.

Credit Repair Services FAQ

How Do I Get Started?

Get Your Free Credit Analysis:

Sign up and allow us to order your credit report through MYSCOREIQ or another credit monitoring service. Our experts will analyze your report, pinpointing any inaccuracies or negative items that need to be addressed.

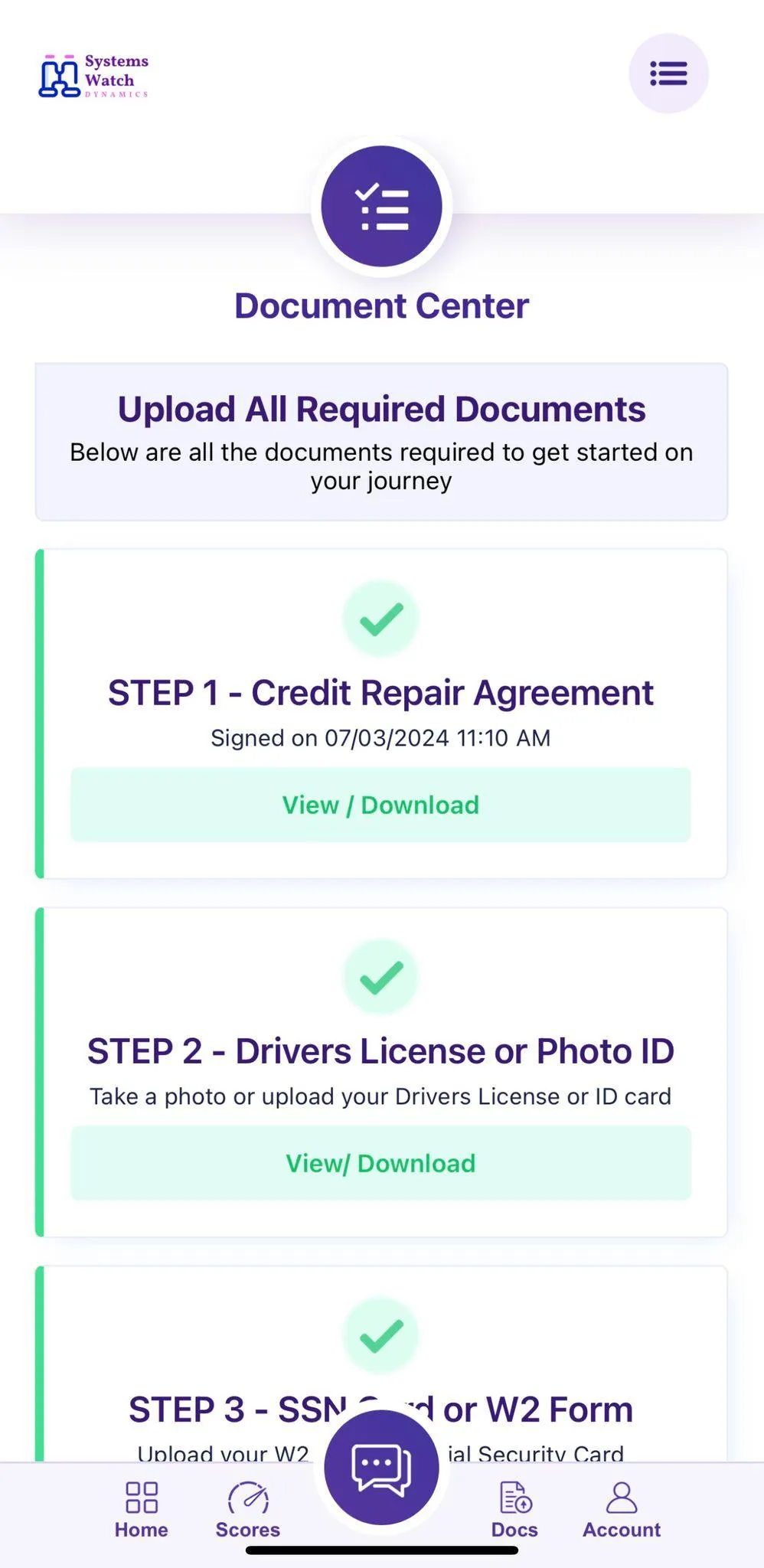

Complete Enrollment:

After receiving your login details, access your secure client portal to finalize enrollment.

Steps include:

● Signing the service agreement.

● Uploading necessary documents like a government ID and proof of address.

● Submitting any additional information for your disputes.

Dispute Process Begins:

Once enrolled, we initiate disputes with all three credit bureaus; Experian, TransUnion, and Equifax. Our team works diligently to address inaccuracies and negative items on your behalf.

Track Progress in Real-Time:

Monitor the status of your disputes anytime through the client portal. Stay informed with regular updates as disputes are processed.

See Your Credit Improve:

Watch your credit score rise as errors are removed and issues are resolved. We continue working on unresolved items to help you achieve the best results.

What Do I Get When I Join?

Our credit repair program provides a comprehensive solution to improve your credit.

Here's what's included:

● Detailed credit repair, restoration, and consulting services.

● A flexible monthly plan with no surprise costs.

● No cancellation fees or long-term contracts, you can cancel anytime.

● A 90-day money-back guarantee for unresolved cases.

● Access to an intuitive credit tracker app to stay updated on your progress.

We are committed to transparency and flexibility, ensuring you have the tools and support to rebuild your financial health.

What Do I Get When I Join?

Our credit repair program provides a comprehensive solution to improve your credit.

Here's what's included:

● Detailed credit repair, restoration, and consulting services.

● A flexible monthly plan with no surprise costs.

● No cancellation fees or long-term contracts, you can cancel anytime.

● A 90-day money-back guarantee for unresolved cases.

● Access to an intuitive credit tracker app to stay updated on your progress.

We are committed to transparency and flexibility, ensuring you have the tools and support to rebuild your financial health.

How Do You Remove Negative Items?

We use the Fair Credit Reporting Act (FCRA) and other consumer protection laws to dispute inaccurate, outdated, or unverifiable information on your credit report. Our team challenges these negative accounts directly with credit bureaus, creditors, and collection agencies, ensuring every item is accurate, fair, and verified.

Our strategies include using tools like Metro 2, direct correspondence with creditors, fraud protection laws, and legal negotiations to remove harmful items from your report. This personalized approach helps pave the way for your credit recovery.

Do You Offer Credit Sweeps?

No, we provide legal and ethical credit repair services to help clients rebuild their credit following applicable laws and practices.

What Types of Negative Items Can You Dispute?

We can help remove a variety of items, including but not limited to the following:

● Credit inquiries

● Bankruptcies

● Public records

● Charge-offs

● Late payments

● Medical bills1 Column

● Evictions

● Collections

● Repossessions

● Tax liens

● Child support defaults

● Judgements

● Foreclosures

● Student loans

● CheckSystems (closed bank accounts with balances)

● Personal information clean-up (e.g., duplicate names, incorrect addresses)

Having outdated or inconsistent personal details on your credit report, such as multiple names or incorrect addresses, can also lead to credit denials. We address these issues to ensure a clean credit profile.

How Much Can My Credit Score Improve?

Score improvements vary depending on the individual and their credit report. Most clients see an increase of 30 to 90 points within the first three months. While results depend on specific factors, our team is committed to achieving the best possible outcome for you.

How Long Should I Stay in the Program?

Many clients begin seeing results within three months. For optimal results, some may stay in the program for 8–12 months depending on their credit goals. We tailor our approach to meet your unique needs

Start your credit repair journey today and unlock a brighter financial future!

Escaping Chexsystems & EWS

Immigrants Guide to

Personal Credit Mastery

TRUMP VS. STUDENT LOANS: Fight Back or Fall Behind: Student Loans Under Attack

Credit Savvy Teens: Score 850 before 20

Escaping Chexsystems & EWS

Immigrants Guide to

Personal Credit Mastery

How to Improve your FICO Scores

Credit Savvy Teens: Score 850 before 20

DIY Hard Inquiry Removal Letter Template

$55.00 $10.00

DIY Collection Dispute Letter Template

$55.00 $10.00

DIY Rental Eviction Removal Letter

$55.00 $10.00

DIY Charge-Off Removal Letter Template

$55.00 $10.00

DIY Foreclosure Removal Letter

$55.00 $10.00

DIY Repo Removal Letter Template

$55.00 $10.00

DIY Late Payment Removal Letter

$55.00 $10.00

"Your financial future isn't written in stone, it's built by the actions you take today."